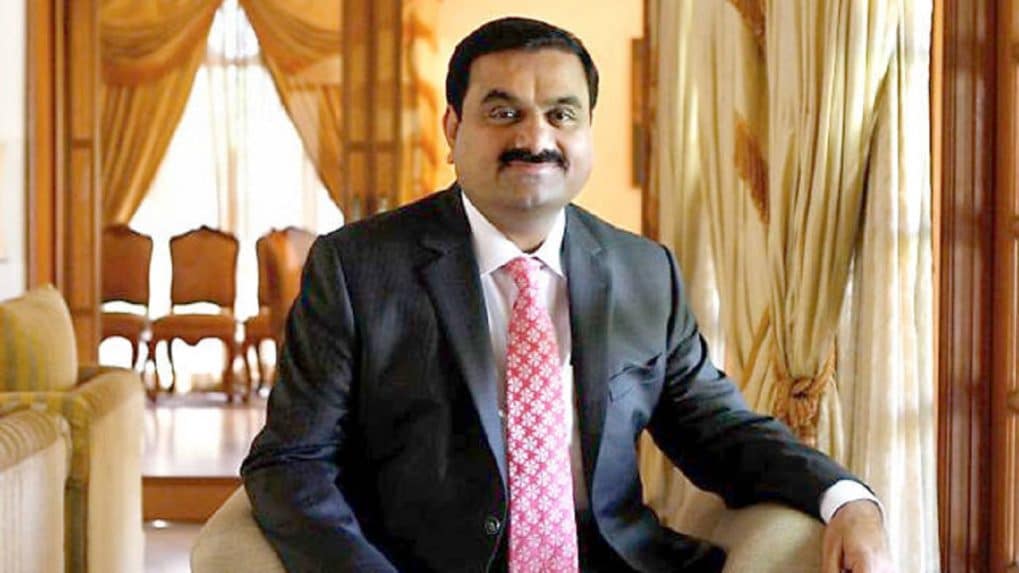

The Adani Group of businesses’ regular market capitalisation on the BSE at over ₹ 22 lakh crore makes it the most valued in India.

The Adani enterprise of businesses’ regular market capitalisation on the BSE at over ₹ 22 lakh crore makes it the most valued in India, overtaking the Tata-led conglomerate.

Based on Friday’s close to, the market valuation of all BSE listed stocks of Adani Group, totalling nine businesses, which encompass the these days received Ambuja cement and ACC LTD, stood at over ₹ 22 lakh crore, surpassing 27 of Tata Group of businesses listed with a market capitalisation (market cap) of greater than ₹ 20 lakh crore.

Mukesh Ambani’s enterprise of nine companies stood 1/3 on the list with a market capitalisation of greater than ₹ 17 lakh crore.

That indicates a broader run-up in Adani stock, which pushed Gautam Adani to turn out to be the 1/3 richest withinside the worldwide on the Forbes list of billionaires, overtaking Amazon founder Jeff Bezos, and behind Elon Musk and Louis Vitton’s Bernard Arnault.

While Mr Adani, with a net valuation of $154.7 billion currently, in quick handed Louis Vitton’s Bernard Arnault, a bloodbath in domestic stocks on Friday pushed him all another time to No. 3 on the Real-Time Billionaires List compiled thru Forbes.

That is basically driven thru the wealth erosion of American billionaires from the modern-day market crash on expectations for a very aggressive Federal Reserve after a red-warm temperature inflation reading.

Gautam Adani’s upward thrust in wealth is also greater a diploma of a leap withinside the valuation of stocks in vicinity of the give up quit quit end result of a upward thrust in fundamentals, which incorporates profits and growth, with some of the entities’ shares controlled thru him developing sharply.

Still, Gautam Adani’s ascent, thru about any diploma, has been no longer whatever quick of remarkable.

First, he have turn out to be the richest character in Asia. Then his net actually properly definitely well truely properly really well worth handed those of Warren Buffett and Bill Gates. Now he’s fast drawing close to to a degree of wealth best rivalled thru Louis Vitton’s Bernard Arnault and Elon Musk.

The market valuation of the Adani Group of businesses is greater spread in the course of entities, at the identical time as one or large entities form the majority of Tatas and Reliance’s market cap.

The Adani Group, which incorporates seven publicly listed companies withinside the infrastructure, mining, strength, and one-of-a-kind industries, is led thru Mr Adani, a first-technology entrepreneur.

A speedy diversification spree has pushed his vast, in big element fossil-fueloline driven conglomerate proper right proper right into a raft of latest sectors in and out of doors of India, and Mr Adani is looking for to reinvent himself for the global diploma.

Adani Enterprises has made large investments in growing industries over the past five years, which encompass airports, cement, copper refining, facts centres, green hydrogen, petrochemical refining, roadways, and solar mobileular production.

Adani enterprise have turn out to be the second-largest cement maker withinside america of americaa after completing its acquisition of Ambuja Cements and ACC on Friday. The enterprise had no cement-making operations previously but had said the businesses have been a outstanding in form given its ports and logistics, strength and real belongings businesses.

Adani Group has large intentions to expand its greaen hydrogen and airport operations and enter the telecom industry. It has moreover pledged to invest $70 billion in infrastructure for renewable strength.

A separate record showed Adani Wilmar is scouting for close by and remote places acquisition dreams as Asia’s richest man doubles down on boosting his empire’s food operations.